child tax credit september 2021 delay

Ad Tax Strategies that move you closer to your financial goals and objectives. It will also let parents take advantage of any increased payments they.

Odsp Payment Dates And Benefits 2022 Everything You Need To Know

Each month the payments will be either 300 or 250 for each child.

. Youll just have to wait until 2022. You can still access the child tax credit which for the 2021 tax year is worth up to 3600 per kid under 6 and 3000 per kid between 6 and 17. 151 PM CDT September 20 2021.

601 ET Sep 29 2021. We have resolved a technical issue which we estimate caused fewer than 2 of CTC recipients not to receive their September payment. SOME cash-strapped families were left waiting for their 300 stimulus check after a technical issue caused Septembers child tax credit payments to be delayed.

Ad Parents E-File to Get the Credits Deductions You Deserve. The Internal Revenue Service said a technical issue is to blame for some people. September 26 2021 103 PM.

Now the delays might cause some hiccups for some when it comes to receiving an advance payment of the Child Tax Credit another new change this year. The Child Tax Credit Update Portal is no longer available but you can see your advance payments total in your online account. September 15 October 15 November 15 and December 15.

The Internal Revenue Service said Sept. 15 some families are getting anxious that they have yet to receive the money according to a. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

Parents eagerly expecting their third enhanced Child Tax Credit payment last week say they experienced a delay in getting the money as expected. Subsequent payment dates are. This will allow new parents with a baby born in 2021 to take advantage of the tax credit payments they now qualify for.

At 300 per month for children under 6 years old and 250 for kids up to 11 years old the dollars add up. Even if you dont owe taxes you could get the full CTC refund. Also while the credit is normally paid as a single lump.

17 that it was aware. One parent with four children told KDKA that he really misses the 1000 he was supposed. For this year only the Child Tax Credit is worth up to 3600 for children under the age of 6 and up to 3000 for children aged 6 to 17.

The March 2021 American Rescue Plan Act includes a credit of up to 3600 per year for children under age 6 and 3000 per year for children ages 6. 2021 Child Tax Credit and Advance Payments. This isnt a problem to do.

601 ET Sep 29 2021. Checks were supposed to be sent out on September 15 and millions of Americans were due to receive the cash days later. The monthly checks can be worth as much as 300 for each child under six years old.

Some child tax credit payments delayed or less than expected IRS says. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Congress fails to renew the advance Child Tax Credit. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. The IRSs statement reads.

Increases the tax credit amount. Up to 300 dollars or 250 dollars depending on age of child. CTC checks will continue to go out on the 15th of every month for the rest of 2021.

While the latest installment of the 2021 Child Tax Credit payments was issued by the IRS on Sept. Removes the minimum income requirement. 27 2021 1203 pm.

After the July and August payments the first two in the special 2021 child tax credit payment schedule were made on time the September one is taking longer for some. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. The 2021 CTC is different than before in 6 key ways.

Some families have reported issues with child tax credit payments as well as tax returns and stimulus checks. We dont make judgments or prescribe specific policies. See what makes us different.

However the IRS expected the delayed September child tax credit payments to hit bank accounts on Friday. The total child tax credit for 2021 is 3600 for each child under 6 and 3000 for each child 6 to 17 years old. Makes the credit fully refundable.

The tax credits maximum amount is 3000 per child and 3600 for children under 6. We provide guidance at critical junctures in your personal and professional life. September 28 2021 1027 AM.

During the week of September 13-17 the IRS successfully delivered a third monthly round of approximately 35 million advance Child Tax Credits CTC totaling 15 billion. Up to 1800 dollars or 1500 dollars depending. Some eligible parents who are missing their September child tax credit payments should get them soon.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Using a 2019 return if a 2020 return isnt. AUSTIN Texas This past week the Internal Revenue Service IRS sent out the third round of approximately 35 million child tax credits totaling 15.

IR-2021-188 September 15 2021. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The deadline for eligible families to opt out of receiving the 250 or 300 payment per eligible child is Monday October 4.

The September 15 checks were the third round of CTC payments and followed the first checks which went out on July 15 and will continue to go out on the 15th of every month for the rest of 2021. Most families will see the August direct deposit payments in their accounts starting today August 13. Fortunately your family isnt out of luck if you missed Mondays deadline.

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

What Is The Ontario Trillium Benefit 2022 Turbotax Canada Tips

Have You Claimed The Employee Retention Tax Credit New Orleans Citybusiness

2022 Public Service Pay Calendar Canada Ca

Cyber Attacks 2021 By Country Konbriefing Com

Cyber Attacks 2021 By Country Konbriefing Com

Cyber Attacks 2021 By Country Konbriefing Com

2022 Public Service Pay Calendar Canada Ca

Will There Be Any Federal Unemployment Benefit Extensions In 2022 For Expired Pua Peuc And Extra 300 Fpuc Programs News And Updates On Missing And Retroactive Back Payments Aving To Invest

Federal Program Aims To Support Lifelong Learning But Analysts Call For Changes Public Policy Forum

Us Utility Renewable Energy Capex Remains On Upswing 2022 Forecast Tops 19b S P Global Market Intelligence

Summary Seasonal Influenza Vaccine Statement For 2021 To 2022 From The National Advisory Committee On Immunization Naci Ccdr 47 9 Canada Ca

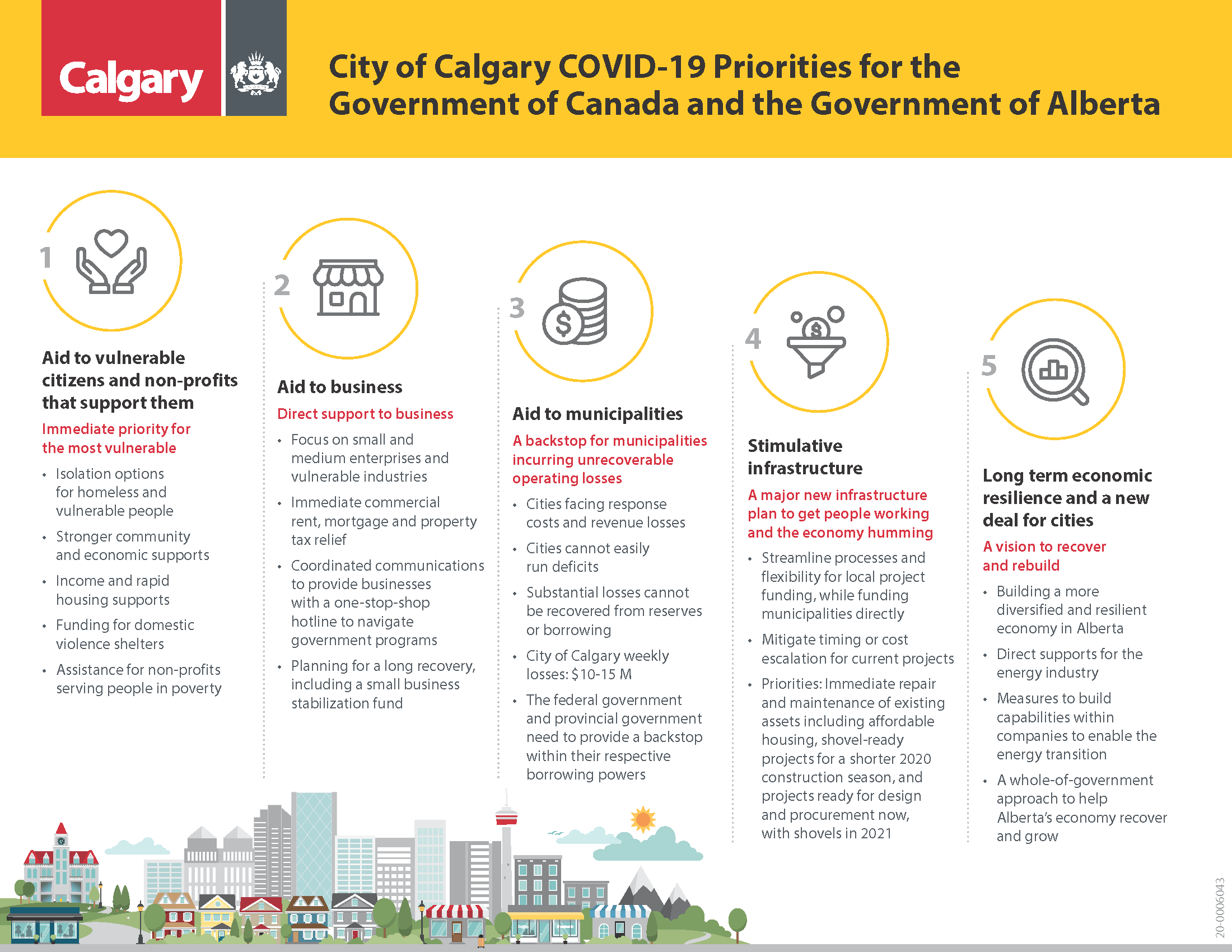

Covid 19 Update Tourism Calgary

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet